2021 was probably an emotional year for investors who holding green energy stocks. Therefore, their opportunity and prospect in 2022 are still the centre of attention.

Many experts believe that, with a solid financial foundation, bright prospects in medium and long term investment, renewable energy stocks are expected to keep growing.

The “Golden Age” of Renewable Energy Stocks

With cheap capital; “F0” investors, the new generation who have opened their first stock accounts since 2021, entering the stock market; Vietnam's macroeconomy is recovering; positive signals from investors and billions has flowed to the stock markets; etc, VN-Index achieved many milestones and broke a number of records in 2021.

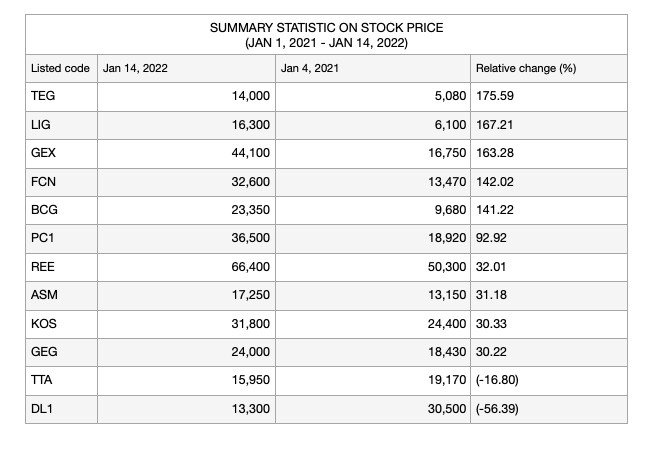

According to statistics from January last year to January this year, most stocks of renewable energy companies all grew significantly, Truong Thanh Energy and Real Estate JSC (TEG) experienced a remarkable growth of 175.59 per cent, Licogi 13 JSC (LIG) came after with 167.21 per cent, Gelex Group JSC (GEX) gained 163.28 per cent, Fecon JSC (FCN) increased 142.02 per cent, Bamboo Capital Joint Stock Company (BCG) rose 141.22 per cent.

Sharing about the underlying reasons, Mr. Ha Duc Tung - an analyst of VNDirect Securities JSC said: "There are a few reasons why renewable energy stocks have risen sharply in recent years, such as: the draft proposal for the national power development master plan for the period of 2021-2030, with a vision to 2045 (“Draft PDP8”) recognized the importance of renewable energy and predicted that this type will account for the vast majority of power sources; The commitment of the Vietnamese government to achieve net zero emissions at COP26 is also a great signal for businesses to expand wind and solar power; Renewable energy sources will be preferred according to the government orientation. In addition, electricity demand was forecasted to recover fully in 2022.

Besides, there are also other factors which have contributed to their growth.

For example, BCG has many cooperation deals with Siemens Gamesa Renewable Energy (Germany); SP Group (the leading power company in the Asia-Pacific region); Sembcorp Utilities, etc; Or, GEX with its subsidiary, Gelex Electrical Equipment JSC (Gelex Electric), listed on UPCOM.

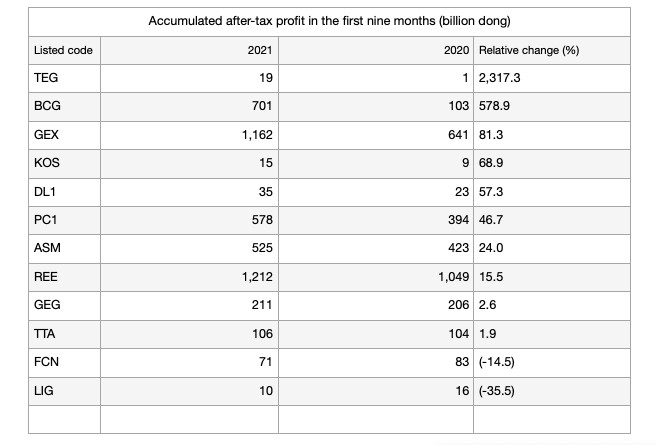

The majority of renewable energy companies had great business performance in the first nine months of 2021.

Net revenue of TEG in the first nine months in 2021 reached VND 199.4 billion, nearly 44% higher over the same period the prior year. Besides, TEG also received 13.6 billion dong of divestment. As a result, the company's net profit reached more than 19 billion dong, an increase of more than 2.317% - the highest growth compared to its counterparts.

Following by BCG, in the first nine months last year, BCG's net profit reached VND 701 billion, up nearly 579% over the same period the year before. According to the corporation, this remarkable achievement was due to the sales of many projects, and cash flow from ones which were finished at the end of last year.

Came after TEG, BCG was GEX with profit of 1,162 billion dong (+81.3%), KOS 15 billion dong (+68.9%), DL1 35 billion dong (+57.3%), etc.

In terms of ROE, BCG ranked first with 13.74%, followed by PC1 (12.52%), REE (12.27%), GEX (8.56%).

On the other hand, REE ranked first since its ROA reached 6.68%, followed by PC1 (4.78%), ASM (3.26%), TEG (3.02%).

Will renewable stocks keep growing?

Many analysts expect that green energy stocks still have big, untapped growth opportunity.

Yuanta Securities Vietnam Joint Stock Company (YSVN) assessed that the "thirst" for power can last for many years. Specifically, YSVN predicts that the ratio of electricity growth to GDP will remain at 1.4x during the next five years, thereby electricity demand is forecasted to grow by 9.8%/year, corresponds to the expected GDP growth in the 2021-2030 period (6.5% -7.0%).

Concur with that opinion, Agriseco Research expected that the power sector will rebound from 2021 level, following the recovery of the economy. In the medium and long term, gas-fired thermal power and renewable energy are forecasted to gradually replace traditional energy sources such as coal and hydroelectricity.

According to the draft proposal for the national power development master plan for the period of 2021-2030, with a vision to 2045 (“Draft PDP8”), the capacity of solar and wind power are 35 GW and 41 GW respectively by 2045, accounted for 20% and 23.3% of total electricity generation. Thanks to renewable energy investment incentives, the capacity of solar PV has reached 16,500 MW, accounted for 25% of total electricity generation, that translates to over 85% of the plan by 2025. Meanwhile, wind power is at the beginning of its development, needs 7 kMW more to reach the target by 2025, CAGR +30%. Based on this prediction, Agriseco Research believed that wind power will be supported in the coming years to achieve the target growth.

Notably, data from Agriseco Research shows that, thanks to the application of technology and price competition among turbine and solar cell suppliers all around the globe, net costs (including installation costs, management costs, operation, management, maintenance and other costs during construction and operation) of renewable energy projects is decreasing.

As a result, the cost for onshore solar and wind power projects will probably be cheaper than coal power in the next few years when the equipment market is more competitive. This trend will ensure profit margins for investors in new projects when the price mechanism gradually shifts from the fixed incentive to bidding.

Meanwhile, in a recent analytical report, VNDirect Securities JSC has recommended green stocks with attractive FIT prices. In addition, government policies may support some wind energy producers such as HDG, GEG, REE, PC1, etc.