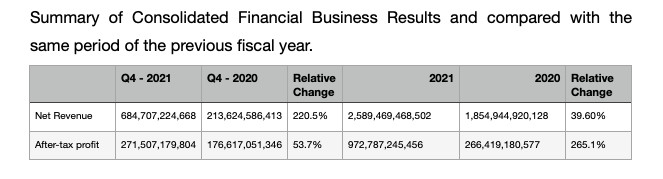

(BCG) - The Company delivered impressive financial performance for the fourth quarter with net revenue of more than VND 648 billion, after-tax profit of nearly VND 272 billion. Its revenue and profit reached VND 2,589 billion and VND 973 billion respectively in 2021.

Compared to 2020, Consolidated net revenue in the fourth quarter of 2021 increased to VND 684 billion (220.5% over the same period) and 49.7% higher than VND 457 billion of the third quarter the same year. Net revenue in its fiscal 2021 reached more than VND 2,589 billion, up 39.6% compared to that of 2020.

In which, the infrastructure sector made the major contribution to the growth with completing 96% of the revenue target. Despite the revenue from the King Crown Village villa project, the real estate segment only achieved 12% of the target revenue due to impact of COVID-19 pandemic, which has delayed construction progress as well as the project handover, a typical example is the Malibu Hoi An project. This led to BCG’s failure of achieving its target revenue. However, these real estate projects are expected to be handed over the year after, therefore 2022 is forecasted to be the year witnessing outstanding growth in both revenue and profit.

In terms of profit, 2021 witnessed a phenomenal growth, which exceeded its initial plan. BCG's 4Q21 consolidated NPAT was nearly 272 billion dong, up 53.7% compared to the same period of 2020. Furthermore, BCG's accumulated NPAT for the whole year of 2021 reached approximately VND 973 billion, an impressive growth of 265% compared to the same period last year and exceeded 20.6% its 2021 plan.

The strong increase in BCG's 2021 profit mainly came from financial activities, M&A deals in real estate and renewable energy sectors in particular, such as: Amor Garden Hoi An project, Cau Rong residential project, share transfers of renewable energy projects and rooftop solar development.

Before that, BCG's General Meeting of Shareholders set business goals for 2021 with revenue of VND 5,375 billion and profit after tax of VND 806 billion. Therefore, compared with the targets, BCG earned only 48% of the planned revenue and 120% of the planned profit due to the impact of the COVID-19 pandemic. In spite of that BCG hit all time record revenue so far.

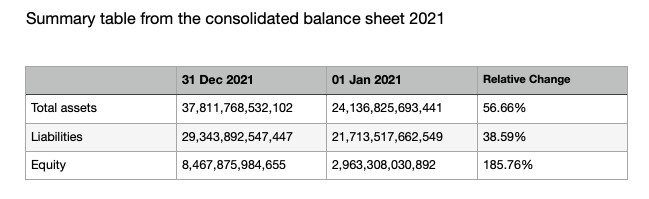

On December 31, 2021, BCG's total assets reached nearly VND 38 trillion, up 56.7% from the prior year due to mainly long-term assets development. In particular, fixed assets increased to 1,495.3% and the proportion of fixed assets in long-term assets also increased by 24.83%. It demonstrates that BCG is still promoting investment in order to ensure projects stay on schedule even amid the Covid-19 pandemic.

In 2021, the capital raising helped BCG quickly improve its leverage ratio with the debt-to-equity ratio falling from 7.15 times at the end of 2020 to 3.47 times at the end of 2021.

In particular, BCG has raised capital in order to balance the financial structure by converting 900 billion dong of bonds into shares and issuing shares to existing shareholders at the ratio 2:1. In addition, BCG's subsidiaries have also worked with strategic investors and have reached some investment agreements. The new capital is going to be used to support the operation and development of key projects in renewable energy, manufacturing and infrastructure sectors.

Recently, Mr. Pham Minh Tuan - Vice Chairman revealed that BCG is expected to adjust its 2022 revenue and profit goals to be higher than the initial plan announced at the 2021 General Meeting of Shareholders due to the positive signs from the real estate segment. Based on the project handover plans, in 2022, BCG Land is expected to earn revenue of about VND 4,800 billion. Notably, Nguyen Hoang - a BCG subsidiary company operating in the furniture manufacturing industry will be listed on UPCoM in 2022.