(VnDirect) On July 6, we visited some real estate projects in Hoi An and met BCG personnels.

Power output in 5T22 reached 255 million kWh, means a year-over-year increase of 15%.

BCG is putting more effort in order to prepare for Khai Long wind power phase 1 (100MW), Dong Thanh phase 1 (80MW) while waiting for new policies.

Based on our assessment, the corporation is finishing the Malibu Hoi An and Hoi An D'Or projects on schedule, they are expected to contribute 85% of BCG's revenue from real estate sector in 2022.

Energy segment: 5T22 business performance and project preparation indicate business prospect.

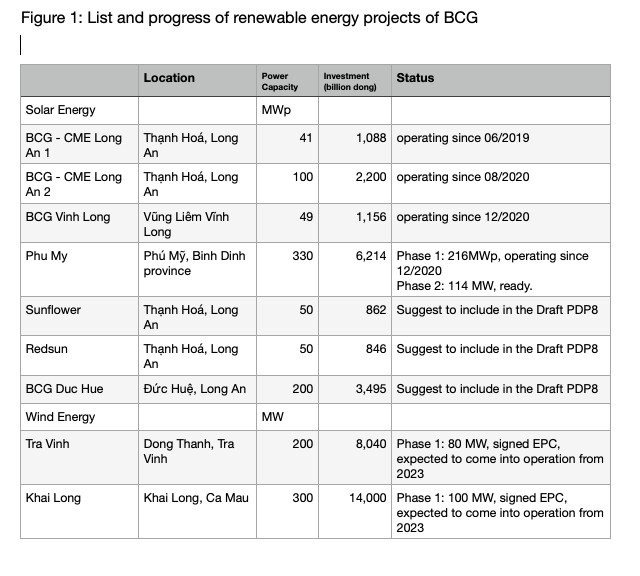

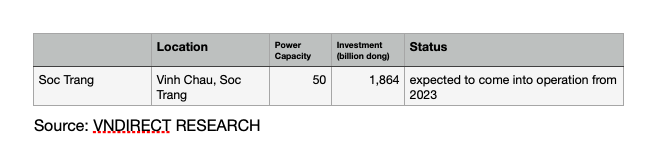

- Currently, the corporation has a total capacity of 579MW of solar power. It is expected that the number will increase by 229MW by 2023. By 2025, the total designed capacity of BCG is going to be about 1,249MW; in which solar power and wind power are the main contributors.

- Power output of 5T22 reached 255 million kWh, an increase of 15% year-over-year growth, most of which came from solar power projects.

- Investment in solar power: Currently, Phu My has been completed phase 2 - 114MW, waiting for permissions to step into operation.

- Additionally BCG is negotiating to include Redsun, Sunflower and Duc Hue in the national power development master plan for the period of 2021-2030, with a vision to 2045 (“Draft PDP8”).

- Regarding investment in wind power: Khai Long Phase1 (100MW) and Dong Thanh Phase1 (80MW) have completed the EPC contracts and are preparing for the construction. The corporation is confident on this segment since related tasks such as EPC, applying for licenses, preparing capital are going smoothly while waiting for the new green energy price policy.

Regarding capital support, by June 21, BCG had contacted two foreign banks. Besides, BCG also has an additional capital of 2,500 billion from issuance, and has funded approximately 1,800 billion to BCG Energy to implement projects. In addition, the company is confident in its ability to access green capital (ESG). BCG is currently working with USS, consulting and evaluating to ensure projects will meet the standards, thus attract ESG capital flows. Also, BCG Energy is expected to be able to complete the needed documentation to IPO by the end of this year, the parent company will hold at least 51%.

Real estate: We can see that projects bringing profit in 2022 are all on schedule.

In terms of challenging policies and sources of credit for the sector, BCG shared the capital for ongoing projects has been prepared, however, in the In the future, it will still need to wait for new policies to decide what to do. The company believes that the IPO of BCG Land will bring an additional source of capital for future projects. Progress of projects expected to earn revenue in 2022:

Hoi An D'Or: Currently, the shophouses are basically completed and sold out 100%, we are finishing them up with the surrounding landscape and plan to hand them over this July, continue to finish the villas.

Malibu Hoi An: The company is putting more effort to reduce the time to complete the landscape and hand over the condotel in Q3/22

IPO BCG Land: The company is completing needed documentation and is expected to submit it in July, the listing time is expected to be at the end of Q3/22.

Cat Trinh Industrial Park: Total investment is expected to be 182 million USD, with a total area of 368ha, the corporation expect in Q3/22 to complete the legal documentation and start the project.

We had field trips to key projects in Hoi An, which are expected to contribute the majority of revenue in 2022 including Malibu Hoi An and Hoi An D'Or projects. We forecasted the two projects will contribute about VND 4,300 billion, accounting for 85% of BCG's total real estate revenue in 2022.

Real estate: We can see that projects bringing profit in 2022 are all on schedule.

In terms of challenging policies and sources of credit for the sector, BCG shared the capital for ongoing projects has been prepared, however, in the In the future, it will still need to wait for new policies to decide what to do. The company believes that the IPO of BCG Land will bring an additional source of capital for future projects. Progress of projects expected to earn revenue in 2022:

Hoi An D'Or: Currently, the shophouses are basically completed and sold out 100%, we are finishing them up with the surrounding landscape and plan to hand them over this July, continue to finish the villas.

Malibu Hoi An: The company is putting more effort to reduce the time to complete the landscape and hand over the condotel in Q3/22

IPO BCG Land: The company is completing needed documentation and is expected to submit it in July, the listing time is expected to be at the end of Q3/22.

Cat Trinh Industrial Park: Total investment is expected to be 182 million USD, with a total area of 368ha, the corporation expect in Q3/22 to complete the legal documentation and start the project.

We had field trips to key projects in Hoi An, which are expected to contribute the majority of revenue in 2022 including Malibu Hoi An and Hoi An D'Or projects. We forecasted the two projects will contribute about VND 4,300 billion, accounting for 85% of BCG's total real estate revenue in 2022.

.png)

Stock Recommendations

Optimistic: at least 15% earning

NEUTRAL: -10% - 15%

Pessimistic: lower than -10%

Investment recommendations are made based on the stock's expected return, which is calculated as the sum of (i) difference (in percentage) between the target price and the market price at the time of reporting, and (ii) expected dividend yield. Unless explicitly stated in the report, investment recommendations are for 12 months.

Industry Recommendations

POSITIVE Stocks in the industry likely generate a positive outcome based on weighted average market capitalization

NEUTRAL Stocks likely generate average outcome, based on Weighted average market capitalization

NEGATIVE stocks likely generate a negative outcome, based on Weighted average market capitalization

See detailed report: here