(Vietstock) In the upcoming period, Bamboo Capital (HOSE: BCG) will keep focusing on real estate and renewable energy projects. In 2023, the Group expects to reach VND 826.5 billion of net profit. Particularly in 2019, the Group potentially records large cash flow and nearly VND 312 billion of net profit.

Shifting investments into real estate and renewable energy

On November 8th 2019, Bamboo Capital JSC (HOSE: BCG) hosted an investor conference to propose deliver the Group’s fundamental change in strategies in accordance with the market fluctuations.

According to the BCG’s board of directors, the company will maintain its activities in four main sectors in the upcoming years: Agriculture and Manufacturing, Construction and Trading, Infrastructure and Real estate, and Renewable Energy.

Since 2018, BCG has made significant changes in its investment strategy by narrowing inefficient business operations, only retaining successful restructured businesses. At the same time, shifting investments into the high profitability segments such as real estate and renewable energy.

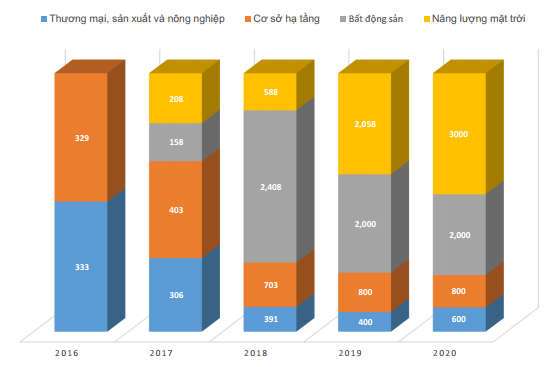

BCG’s investment structure is changing over years (in billion dong)

According to the plan, BCG will reduce to invest its investments in trading and infrastructure segments. In 2018, capital inflow in real estate segment projects increased rapidly due to the Group has been investing in Da Nang, Maiibu Hoi An and Thao Dien projects. In 2019, capital inflow in renewable energy increased sharply due to various investments in solar farm projects in Long An.

In the short term, BCG’s current cashflow is used for the projects in agriculture, manufacturing and trading sectors in order to create a stable cash flow, while keep focusing on investing in medium and long-term projects.

In the medium term, the Group concentrates in developing real estate projects including: Pegas Nha Trang, Bao Loc Urban Area, Loc Phat Residential Area, Hiep Binh Chanh Urban Area, and Hoa Ninh Residential Area.

Pegas Nha Trang project is one of the largest real estate projects of BCG in the near future, with a total investment of VND 782 billion in a scale of 2,738 m2. BCG aims to build a 38-storey hotel and apartment building in Nha Trang.

It is known that this project is the type of Condotel investment. Since there is a concern among investors about the legality of the project, the representative lawyer of BCG answered that this project is built on 50-year licensed land and will easily extend for 50 years more which is also an advantage of the project.

In the long term, the renewable energy segment will contribute effectively to the Group’s growth with stable income and high profit margin. Some projects have been deployed such as Floating Solar Power Plant in Quang Nam and DakLak, Wind Power Plant in Soc Trang province and 3 Solar Power Plant projects which are Sunflower, Redsun and Ben Tre. Even further, the Group is researching on developing Liquefied Natural Gas Plant which is the biggest project in the energy portfolio with total investment of 70,000 billion VND.

In 2020, rooftop solar power projects will be the main investment project of BCG. In 2019, the Group plan is to reach a total capacity of 50 MW.

At the event, Mr. Nguyen Ho Nam – Chairman of BCG’s Board of Directors shared that the Group will cooperate with international corporations to take advantage of their science, technology, brand and cash flow. Currently, the Group also receives support from foreign shareholders to contribute capital to implement solar power projects such as Hanwha Energy and Japan Asia Investment. Besides, BCG is also working with other partners. In addition, the Group will raise additional loans from local banks.

Through these strategies, BCG expects its revenue to reach VND 6,775 and 77% ROE in 2023.

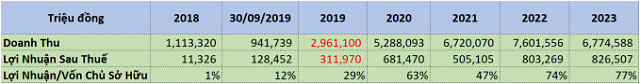

BCG’s revenue forecast in the upcoming years

Forecasting to record large cash flow in 2019 or 2020

By the end of Q3/2019, BCG’s net profit reach VND 244.7 billion partially including the 40 MW solar power plant project which has been officially operated. In addition, some successfully deployed real estate projects such as Radisson Blu Hoi An Resort in Quang Nam and King Crown Village in Thao Dien, District 2 have also come to the final stage.

Due to the high performance of those projects, BCG has transferred some parts of new projects with relatively high price. It leads to a significant growth in financial revenue, recording Q3/2019 net profit of the parent company increased by 2,406% compared to the same period last year, reach more than VND 14 billion. Consolidated net profit in Q3/2019 increased by 1,090% over the same period last year, reach nearly 52 billion VND.

In the first 9 months, accumulated net revenue and net profit reached VND 41.7 billion and VND 128.45 billion respectively.

For 2019, BCG expects to achieve over VND 2,961 billion in revenue and nearly VND 312 billion in net profit. The BOD of the Group supposed this result is achievable because the company is in negotiation for cooperating with some partners. If the negotiation is successful in 2019, it will be recorded in large profit and completed this target. In case of failure to record in 2019, this cash flow will be recorded in 2020.

One of the problems that causes investors’ concern for BCG is the receivables from customers is gradually increasing. Mr. Pham Minh Tuan – Deputy General Director of BCG explained that Group has always been in restructuring period, restructuring investments leads to the fluctuation of receivables and payables, they are either transferred from one place to another or increasing depends on certain period. The important thing is that businesses have to control the cash flow, receivables must be clear. Mr. Tuan quoted his point by showing that the company’s receivables were not made as a provision.

In addition, Mr. Nam said that the company’s receivables sharply increased in 2019 because BCG recorded a large number of receivables from the Malibu Hoi An project (approximately VND 2,000 billion).

Theo Chí Kiên – Như Xuân

FILI

Link bài viết: https://vietstock.vn/2019/11/bcg-chuyen-dich-dau-tu-bat-dong-san-va-nang-luong-ke-hoach-lai-826-ty-nam-2023-737-715057.htm

Các tin tức khác liên quan đến Hội nghị gặp gỡ Nhà đầu tư “BCG – Định hướng tương lai”

Báo Cafebiz: http://cafebiz.vn/bamboo-capital-va-ke-hoach-3-nam-day-tham-vong-moi-nam-doanh-thu-tang-len-xap-xi-tu-1000-ty-dong-den-2000-ty-dong-muc-tieu-tro-thanh-tap-doan-tam-co-the-gioi-20191109002918421.chn

Báo Bizlive: https://bizlive.vn/doanh-nghiep/bamboo-capital-lieu-co-can-dich-chi-tieu-kinh-doanh-2019-3526929.html