(CafeF) In the first 9 months, Bamboo Capital (BCG)’s net revenues reached VND 942 billion, increased 13%. Due to the transfer of high-value projects, gross profit earned VND 128 billion, 6.5 times higher than the same period.

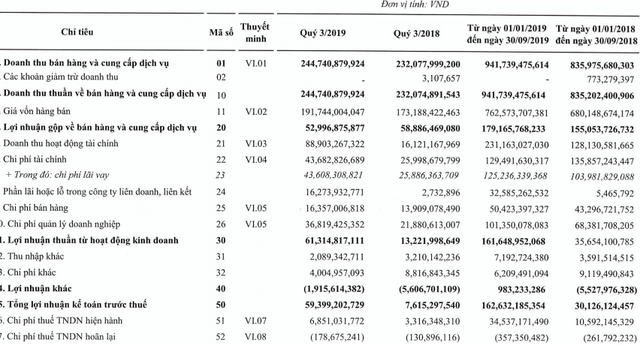

Bamboo Capital (BCG) has released its consolidated financial statements with net revenue of VND 245 billion for the third quarter of 2019, a slight increase compared to the same period in 2018. The increase in cost of capital is the reason for gross profit to decreased slightly to VND 53 billion.

Financial revenue abrupt raised from VND 16 billion to nearly VND 90 billion, which made BCG’s net profit 12 times higher than Q3/2018 with VND 53 billion.

According to BCG, by the end of the third quarter of 2019, solar power plant 40MW project was officially launched. In addition, a lot of real estate projects had been implemented such as Radisson Blu Hoi An Resort in Quang Nam and King Crown Village Villas at Thao Dien, District 2 had gone into good stages.

At the same time, Bamboo Capital had transferred shares from new projects with high transfer prices.

In the first 9 months, the company’s net revenue was VND 942 billion, up by 13%. Due to the transfer of high-value projects, profit after tax earned VND 128 billion, 6.5 times higher than the same period.

By the end of the third quarter of 2019, BCG’s total assets reached VND 6,362 billion, raised 17% compared to beginning of the year. Outstanding long-term loans also increased sharply from VND 700 billion to VND 1,600 billion. In early October, the company had issued VND 900 billion worth of convertible bonds in Q4/2019. The money is intended to be paid to the investors who advance the company for renewable energy and real estate projects.

In released business report, KB Vietnam Securities (KBS) said that investment objectives focused on these two areas had been required large capital from BCG. In particular, development financing mainly comes from loans from credit institutions as well as corporate bonds in the form of periodic interest bonds or convertible bonds.

However, when the projects of Bamboo Capital are officially launched in the period of 2019-2020, will generate positive revenue and profit for the company. Specifically:

(1) Malibu Hoi An is expected to gain VND 3.295 billion of revenue and VND 763 billion of gross profit, with a part of revenue and profit scheduled to be recognized in the fiscal year 2019;

(2) King Crown Village Thao Dien is forecast to record VND 802 billion in revenue and VND 300 billion in gross profit. However, since BCG holds 48.5% of total shares, the profit recorded for BCG will be approximately VND 145.5 billion;

(3) Two solar power plants which are BCG – CME Long An 1 and 2 with total capacity of 40.6MW and 100.5MW, respectively, have started operating since 2019.

In renewable energy, BCG is completing legal procedures for other solar projects in Long An (100MW), Daklak (50MW), Gia Lai (300MW) and Tay Ninh ( 165MW), solar power project on water in Quang Nam (200MW) and a wind power project with total capacity of 50MW in Soc Trang.

In early 2019, the Dinsen Group’s rooftop solar power system in Long An with total capacity of 1MW had been inaugurated. Currently, BCG is developing projects with total capacity of 5MW in the southern provinces with the goal of developing 100MW of solar power on the roof within the next 3 years.

In 2020, Sunflower project will be constructed in the same area. These projects will contribute to BCG approximately VND 5 billion of profit and VND 20 billion in 2019 and 2020.