(Stock market news) 70% capital of Vinataxi Co., Ltd. has just been transferred from an international investor to Helios JSC, a subsidiary of Bamboo Capital Group, led to a new possible business direction.

Vinataxi has a charter capital of VND 112.7 billion, this joint venture was established 22 years ago between Tracodi and ComfortDelgro (CDG), which operating about 40,000 vehicles in seven countries. Vinataxi used to be a household name in Ho Chi Minh city as well as other southern provinces. However, due to the increasingly fierce competition in ride-hailing industry in Vietnam, foreign-owned joint ventures holding at least 70% capital have been limited in business, the devastating impact of Covid-19 pandemic, CDG decided to divest the joint venture.

In an effort to keep a 30-year-old brand and utilize its advantages, Helios Investment and Service Joint Stock Company, a member in the ecosystem of Bamboo Capital Group (BCG), decided to acquire 70% from CDG.

Vinataxi's potentials come from its pioneer taxi brand in Vietnam with the switchboard number 111111, land and factory of more than 6,000 square meter in Tan Binh Industrial Park with many advantages of potential logistics business which is in demand.

Vina taxi plans to switch from traditional taxi to a taxi e-hailing platform.

Along with that, the company also plans to adopt innovative technology to switch from traditional taxis to a taxi e-hailing platform; promote technological innovation, launch a booking app, expand types of transportation; promote non-cash payment and develop many new services based on survey and market research.

Technology is not only applied in the "B to C" model, for example between Vinataxi and customers, but also the management to streamline the business.

In fact, despite many great challenges from both inside and outside business, the transportation sector is still very potential. Whoever can adapt better will survive and thrive.

With the young employees and modern management in the Bamboo Capital ecosystem, determination and hard-work, willing to learn and adopt new models and directions, Vinataxi is expected to have a key turning point in the near future, then Tracodi with 30% ownership will also be beneficial.

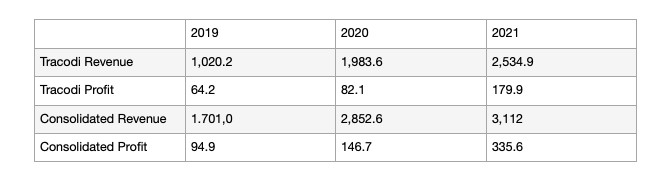

TCD has successfully overcome a tough year, excellent business performance is showed on the table below.

These impressive business performance once again makes Tracodi a leader in the construction industry. It is preparing and accumulating more resources to be ready for further development. The above figures also demonstrated the successful business strategy and effective, outstanding leadership.

At Tracodi's 2022 Annual General Meeting takes place on April 14, the Board of Directors is expected to submit a plan with revenue of VND 4,431 billion, after-tax profit of VND 380 billion, continuing double-digit growth. The company also sets a target to maintain a growth rate of 17 - 18% in revenue and 17% - 20% in after-tax profit in the next three years.

Seizing opportunity of the Government spending on transport infrastructure, Tracodi spends most resources on this sector. In the period of 2022-2027, Tracodi aims to become one of the leading general contractors in Vietnam.

Last year, TCD's consolidated revenue reached VND 3,112 billion, profit after tax jumped to VND 335.6 billion. Compared to the prior year, the revenue increased by 9%, while profit after tax increased by 128%. It is expected that 2022 will continue to be a golden year for Tracodi.