(TCD) On February 27, 2019, Transport and Industry Development Investment Corporation Joint Stock Company (TRACODI – Hose: TCD) was jointly evaluated by Vietnam Assessment Report Joint Stock Company – Vietnam Report and VietNamNet Public Newspaper. TRACODI was in the top 10 fastest growing enterprises in Vietnam 2019.

FAST500 rankings are built based on independent research and evaluation results of Vietnam Report, officially announced for the first time in 2011. Ranking of businesses in the Ranking Table is arranged based on criteria Dual growth (CAGR) in revenue and business efficiency. Besides, the criteria such as total assets, total labor, after-tax profit and corporate reputation on the media … are also used as supporting factors to determine the scale and position of businesses in the industry operate.

After 9 years of successive publication, the Charts marks the relentless efforts of FAST500 business – businesses are considered as “rising stars”, as the driving force of growth. the whole economy.

The official announcement and honouring ceremony The 2019 FAST500 ranking will be held on April 19, 2019, at Park Hyatt Hotel, Ho Chi Minh City. Ho Chi Minh.

Details of the list and ranking of businesses are posted on the website: www.fast500.vn.

Top 10 list of FAST500 2019:

Source: Vietnam Report

In the framework of the announcement of the FAST500 2019 Rankings, Vietnam Report also conducted a survey of growth businesses for 9 years to outline the picture of the overall growth of Vietnamese enterprises, the most important factors contributing to creating success and operational orientation of businesses in 2019.

2014-2018 period: FAST500 enterprises grew stably

In the 2014-2018 period, the average CAGR of double revenue growth of Top 500 Vietnam’s fastest growing enterprises (FAST500) reached 38%.

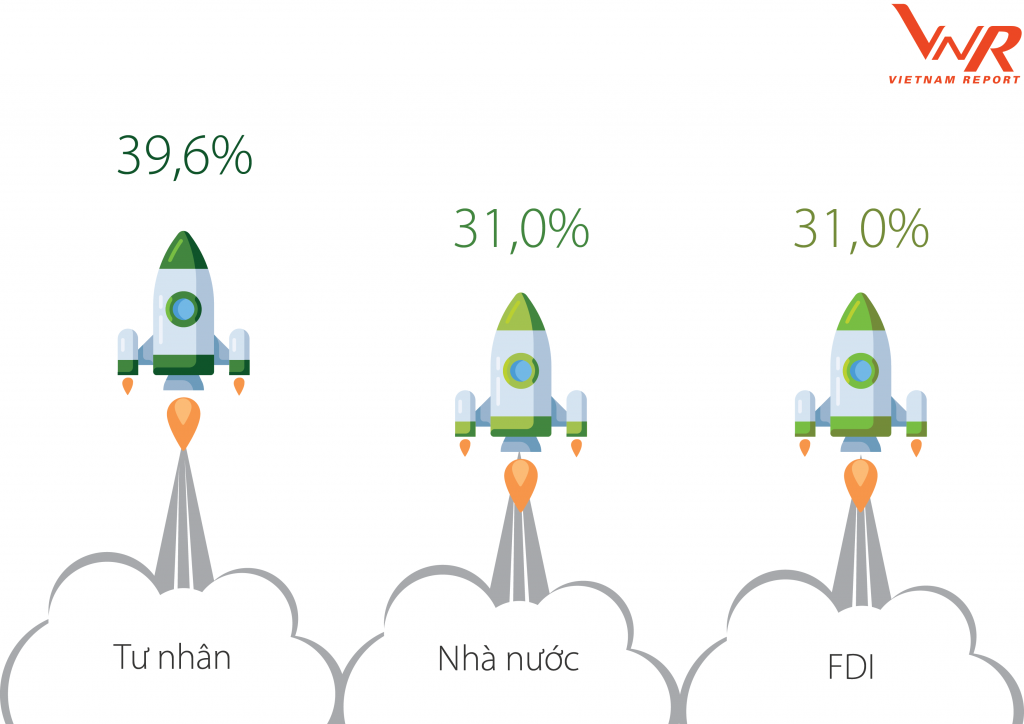

In terms of economic sector, the highlight of growth in this period is that the private sector clearly shows its role as the growing resource of the economy with the largest average CAGR growth rate, 39, 6%, far beyond the other two areas. The private sector also accounts for the largest proportion in the Top 500 fastest-growing enterprises in Vietnam with 81.4% of enterprises. In addition, the foreign-invested sector (FDI) has had the same pace as the state economic sector. This is clear evidence for the efficiency of attracting foreign investment of Vietnam in the past period.

Figure 1: Average economic CAGR of the FAST500 2019 chart

Source: Vietnam Report

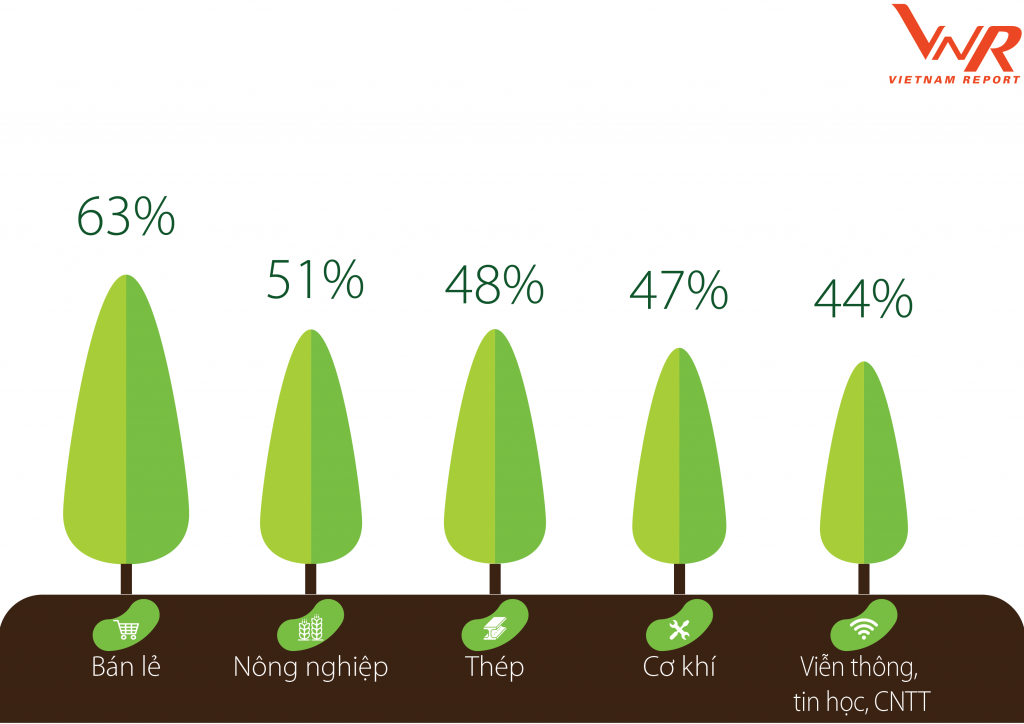

In terms of industry, in recent years, Vietnam market witnessed a strong rise in the Retail industry. In the FAST500 ranking this year, this is also the industry with outstanding growth in the 4-year period from 2014-2017 with an increase of 63%, topping the Top 5 industries with the highest double revenue growth index. Besides, Agriculture, Steel, Mechanical and Telecommunications, informatics, and information technology still maintained their growth position with high average CAGR of over 44%. Continuing to lead the market with the largest number of enterprises in the whole year this year is Construction, Building Materials and Real Estate – accounting for 30% of the total businesses. Thus, it can be said that these figures have partly sketched out the current market picture with growth potential coming from outstanding industries such as Real Estate and Retail – the areas that are expected to become ” Promised land “attracted strong investment for the national economy.

Figure 2: Top 5 industries with the highest average CAGR of the FAST500 2019 chart

Source: Vietnam Report

Through the survey of FAST500 growth enterprises, most businesses were optimistic about the business results in 2018 (85.6% of enterprises rated the revenue in 2018 increased compared to 2017, 64.3% of enterprises Industry determines after-tax profit has increased). With this optimism, nearly 70% of businesses respond to the intention to expand their business in the next phase.

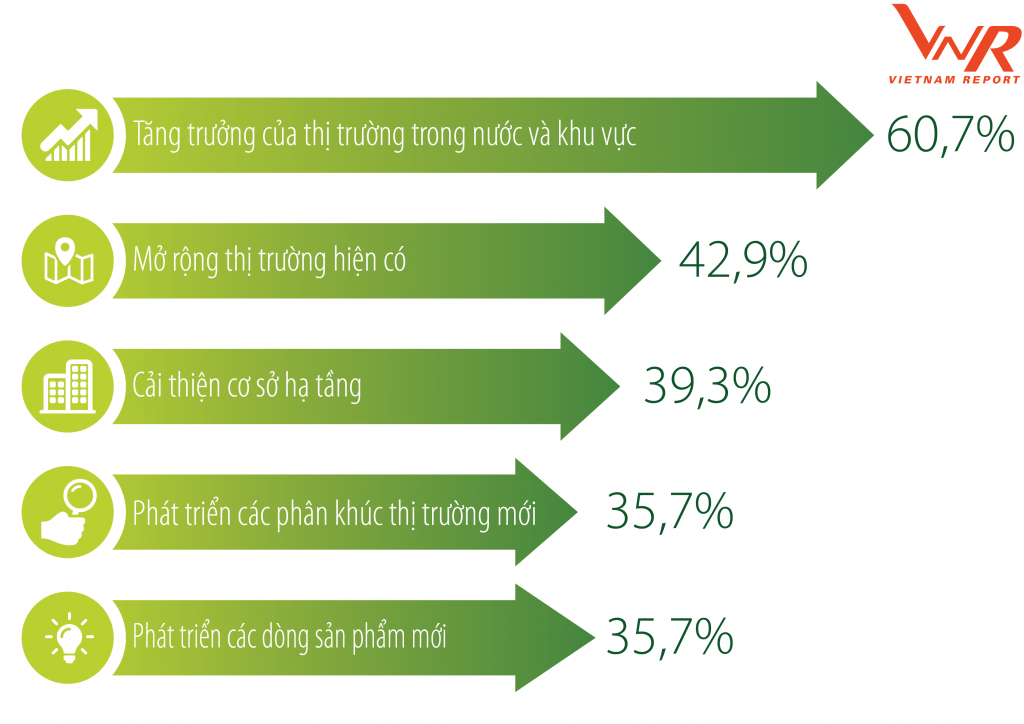

In particular, assess the factors that contribute most to the growth rate of the business in the past 5 years (2014-2018), leading the growth factor of the domestic and regional markets ( 60.7%), followed by the current market expansion (42.9%) and Infrastructure improvement (39.3%). In two consecutive years, many FAST500 businesses have said that the growth of the domestic and regional markets is the main reason for the momentum of the enterprise’s growth, in addition to the efforts of enterprises and the improvement. improving the investment and business environment of the State.

Figure 3: Top 5 factors that contribute most to the growth of businesses in the period 2014-2018

Source: Vietnam Report, Survey on enterprises FAST500, 02/2019

FAST500 enterprise identifies challenges and identifies strategies in 2019

Along with the “miracle” milestones on GDP growth, implementation of socio-economic targets and longer progress through the door of international integration in 2018, FAST500 enterprises said that in 2019, Many new opportunities will open, bringing high optimism about the prospect of this year’s revenue growth in the domestic market. However, there will be many challenges that could become obstacles to business development in the current context.

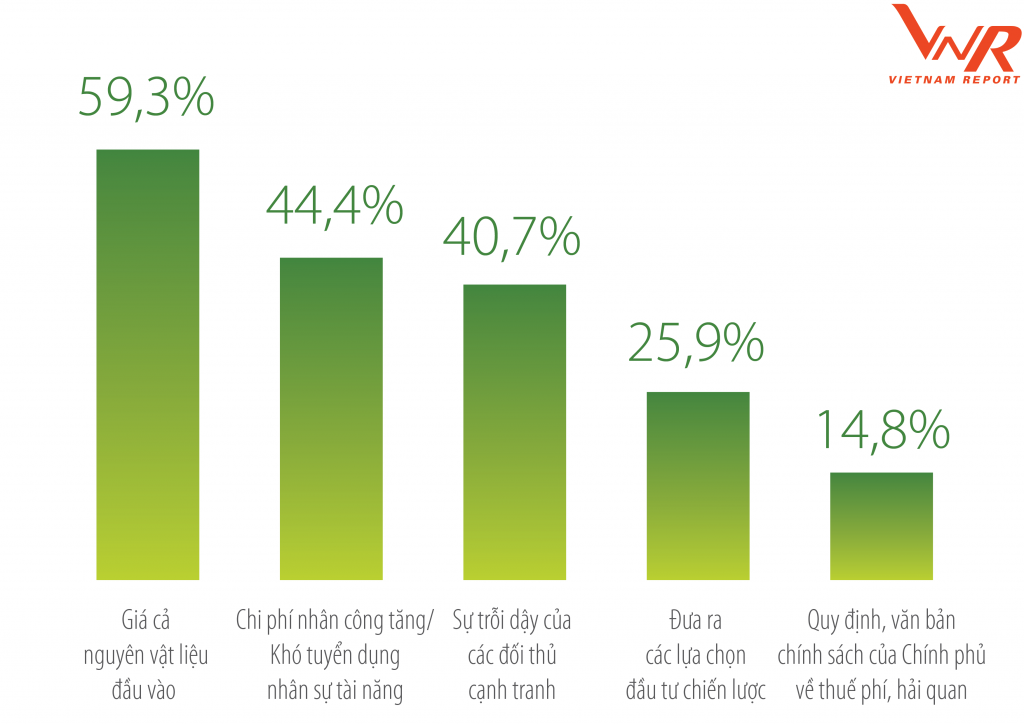

Specifically, the price of input materials, rising labor costs / Difficult to recruit talented personnel, The rise of competitors in the same industry are the three biggest barriers of businesses. In particular, enterprises pay special attention to the issue of input costs; This is also a challenge for many years of businesses along with competition issues. On the other hand, if in the previous year administrative procedures are many businesses feel anxious, then the issue of human resources has risen to become a big challenge. This shows partly the effectiveness of the Government’s reform efforts, the business environment in the past time, and shows that most businesses have identified business challenges in the coming period.

Figure 4: Top 5 biggest challenges for business growth in 2019

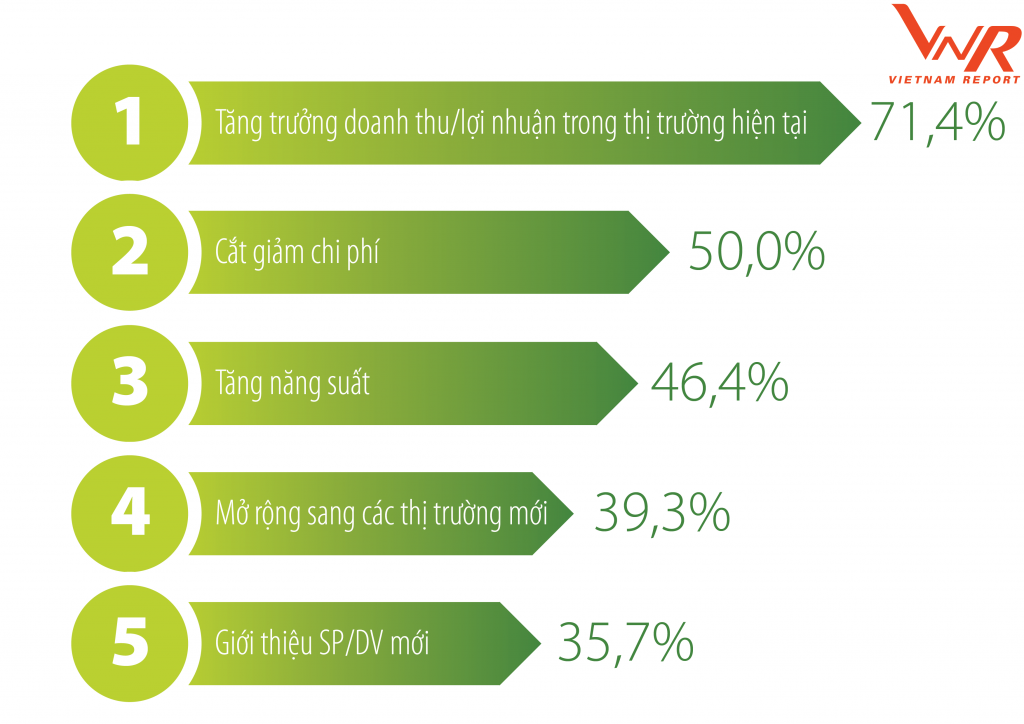

In order to overcome challenges and anticipate growth opportunities, FAST500 businesses all clearly define their strategic direction. Accordingly, the three main priorities in the business strategy of the business this year are in turn revenue/profit growth in the current markets (71.4%), cost reduction (50%) and Increase productivity (46.4%). In addition, Expanding into new markets, Introducing new products/services… are also the orientations that are interested by businesses.

Figure 5: Top 5 priorities for business strategy of enterprises in 2019

Source: Vietnam Report, Survey on enterprises FAST500, 02/2019

In particular, to improve the growth prospect, product/service quality with reasonable prices, human resource quality are all the factors that businesses need to focus on. As for human resources, many businesses are choosing strategic solutions to automate certain functions in the enterprise and General training for the workforce on how to use data to build forces labor adaptation and increased profits in the digital age.

About industries with good growth potential in the next three years, the Top 5 most evaluated sectors of FAST500 are Information Technology, Clean Agriculture, Tourism – Hotels, Clean Technology and Retail. Compared to the evaluation of the enterprise group in the previous year, the above sectors are very promising. This is also reflected in the current trend and development orientation of domestic enterprises, which is aimed at promoting technology development in association with environmental protection, promoting clean agriculture and making tourism a spearhead industry of the country.

Administrative procedures and corporate income tax – need to constantly promote reform

In many surveys of annual FAST500 enterprises, administrative procedures and CIT are always two of the “headache” issues for both businesses and policymakers. In addition to the top two expectations of Continuing to promote administrative procedure reform and continuing to adjust the CIT rate reduction, Credit interest rate reduction is also a policy that businesses expect to have positive progress. in 2019. For businesses, these are all policy recommendations that need to be given top priority to support business operations and growth prospects of businesses in the current period.

In addition, since 2017, Improving the legal environment has also become one of the policies that many businesses care about. According to many experts, improving the legal environment is the “key” to help businesses step through the door of successful integration, anticipating the opportunities that CPTPP and other agreements can bring, and at the same time. continue to stabilize the foundation to achieve sustainable growth-oriented goals.

Figure 6: Top 5 policy recommendations from businesses to better support their business and growth prospects

Source: Vietnam Report

It can be said that the Vietnamese business community is undergoing a transition period with many opportunities and challenges from both domestic and foreign. It is not only a favorable condition thanks to the successes achieved in the context of the macroeconomy is gradually improving, but also the challenge posed after the period reached the “record” GDP 7.08% in 2018. Above all, Vietnam’s progress in the international market in the past has brought greater competition than before. However, after the pressure will be the driving force, along with long-term vision, flexibility, acumen in business strategy and strong determination to break through the resonance from many parties including businesses, the Government and Vietnamese people and businesses can fully expect a progressive and widespread growth, especially in the small and medium enterprises.

Through 9 years of accompanying growing businesses, FAST500 Organizing Committee hopes that more and more enterprises will be listed in the Top 500 fastest-growing enterprises in Vietnam in the coming years. contribute to the overall development of the country’s economy.

Vietnam Report

Source: Vietnamnet.vn